rsu tax rate us

Hope you had a chance to glance over at the official Restricted Stock Unit RSU Strategy Guide. The stock price at vesting in year one is 20 1000 x 20 20000 of ordinary income at year two 25 25000 at year three 30 30000 and at year four 33 33000.

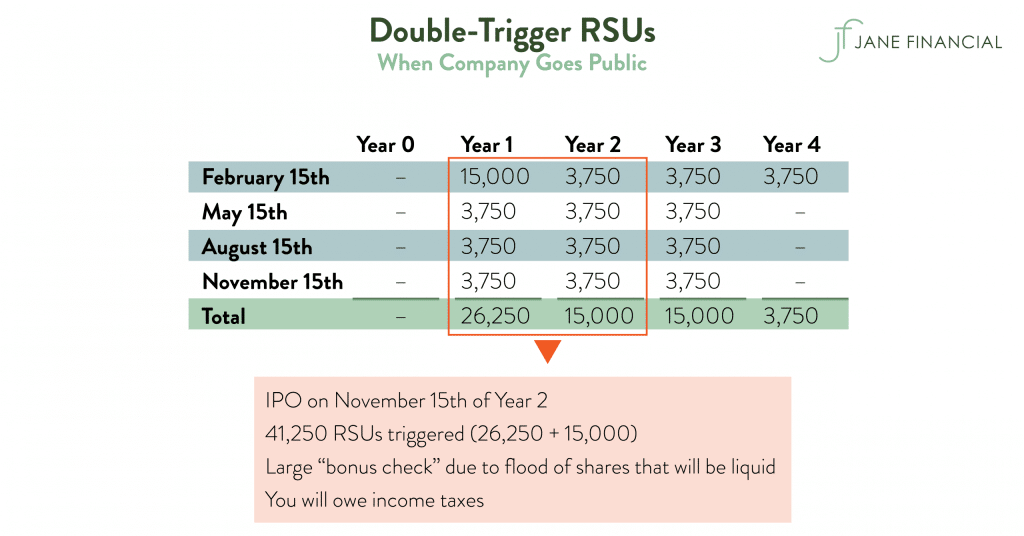

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

The dollar sign rotates to become an icon of a stack of paperwork.

. The IRS and your state and local tax authorities if applicable view this 7500 as compensation income. Here is the information you need to know prior to jumping in. Most employers will withhold taxes on your RSUs at a rate of 22 but you could easily be in a higher tax bracket than that.

Estimate how much your RSU value will increase per year. Stock grants often carry restrictions as well. Long-term capital gains tax on gain if held for 1 year past vesting.

Many companies withhold federal income taxes on RSUs at a flat rate of 22 37 for amount over 1 million. Here is an article on employee stock options. Unlike the much more complicated ESPP they get taxed the same way as your income.

Heres the tax summary for RSUs. RSUs are taxed upon the delivery of shares which is generally upon vesting as income from employment at the progressive tax rate up to 495 percent. For people working in California the total tax withholding on your RSUs are actually around 40.

RSUs can also be subject to capital. This rate is 238 20 plus the 38 tax on net investment income for high-earning taxpayers. Youll need to pay income taxes on this compensation.

The US uses a progressive tax system so its important to be aware of the difference between what your highest marginal income tax rate is and what your effective tax rate is. How your stock grant is delivered to you and whether or not it is vested are the key factors. The 22 doesnt include state income Social Security and Medicare tax withholding.

The stock is restricted because it is subject to certain conditions. The total is 108000 and each increment is taxable on its vesting date as compensation income when the shares. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest.

This will be based on the fair market value of the stock on the vesting date. Restricted stock is a stock typically given to an executive of a company. Rsu tax rate us Sunday March 6 2022 Edit Tax treatment of RSUs in India The RSU perquisite is taxable based on the period of stay during the vesting period and resident status at the time of the grant of option.

Input your current marginal tax rate on vesting RSUs. The beauty of RSUs is in the simplicity of the way they get taxed. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer.

Ordinary tax on current share value. And then immediately lost 12 ending up closing the first day of trading at 34. Decide on your strategy.

Assuming the stock price increased to 250 per share on 122020 you must pay income taxes on the RSU income of 7500 30250. Short-term capital gains tax ordinary income tax rates otherwise this includes immediate sale. Plan For the RSU Vesting Event Once youve used the RSU tax calculator to determine your estimated taxes and estimated proceeds youll want to make a plan so you know what you want to do with your company shares after the vesting date.

Youll see this income and taxes paid for that year on your W2 or relevant tax statement. Robinhood just went IPO on July 28. Generally there is no tax upon the sale of shares if the shareholder together with their fiscal partner has an interest less than 5 percent in the nominal subscribed share capital determined per class of shares.

Restricted Stock Units RSUs Tax Calculator. Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained. For one a recipient cannot sell or otherwise transfer ownership of the stock to another person until the restrictions lift.

Restricted stock units RSUs and stock grants are often used by companies to reward their employees with an investment in the company rather than with cash. The price could have fallen from the IPO list price. How Are Restricted Stock Units RSUs Taxed.

The timing of RSU tax is exactly the same as any other. As the name implies RSUs have rules as to when they can be sold. This happens over time through a vesting schedule.

Marginal is the rate you pay on the next dollar of earned income whereas effective tax rate is the average rate you pay on every dollar of income. Now that you know the basics of how RSUs work you can now confidently use the RSU Tax Calculator Below. This is different from incentive stock options which are taxed at the capital gains rate and tax liability is triggered when the options are exercised.

Enter the amount of your new grant - whether an offer grant or an annual refresh. The beauty of RSUs is in the simplicity of the way they get taxed. RSUs are taxed as W-2 income subject to federal and employment tax Social Security and Medicare and any state and local tax.

This 7500 income from RSU vesting is called supplemental wages by the IRS. You receive 4000 RSUs that vest at a rate of 25 a year and the market price at grant is 18. If you live in a state where you need to pay state income taxes repeat steps 2 and 3 using your state marginal tax rate.

On the other hand the rate for short term gains is the same as that for earned income which is 37 for high-income taxpayers. Robinhood listed at 38. Restricted Stock Units RSUs Tax Calculator.

The RSUs you get will be taxed about half de to it being income and when you sell capital gains whether you sell form the US or Canada. It too offered its employees the choice between 22 and 37 withholding on their RSUs vesting on Day 1. Level 2 Op 20 min.

To use the RSU projection calculator walk through the following steps. Many companies withhold federal income taxes on RSUs at a flat rate of 22 37 for amount over 1 million.

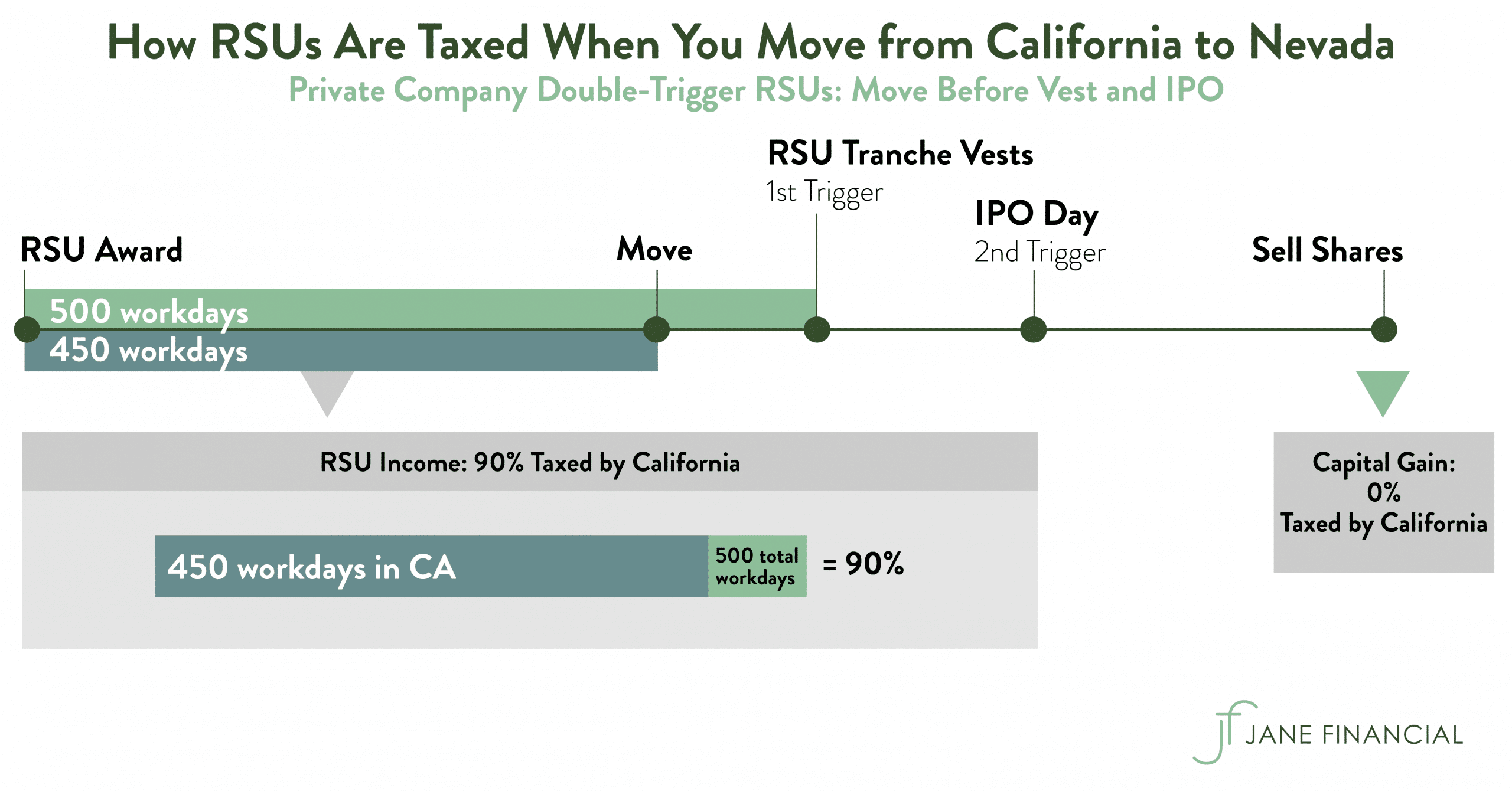

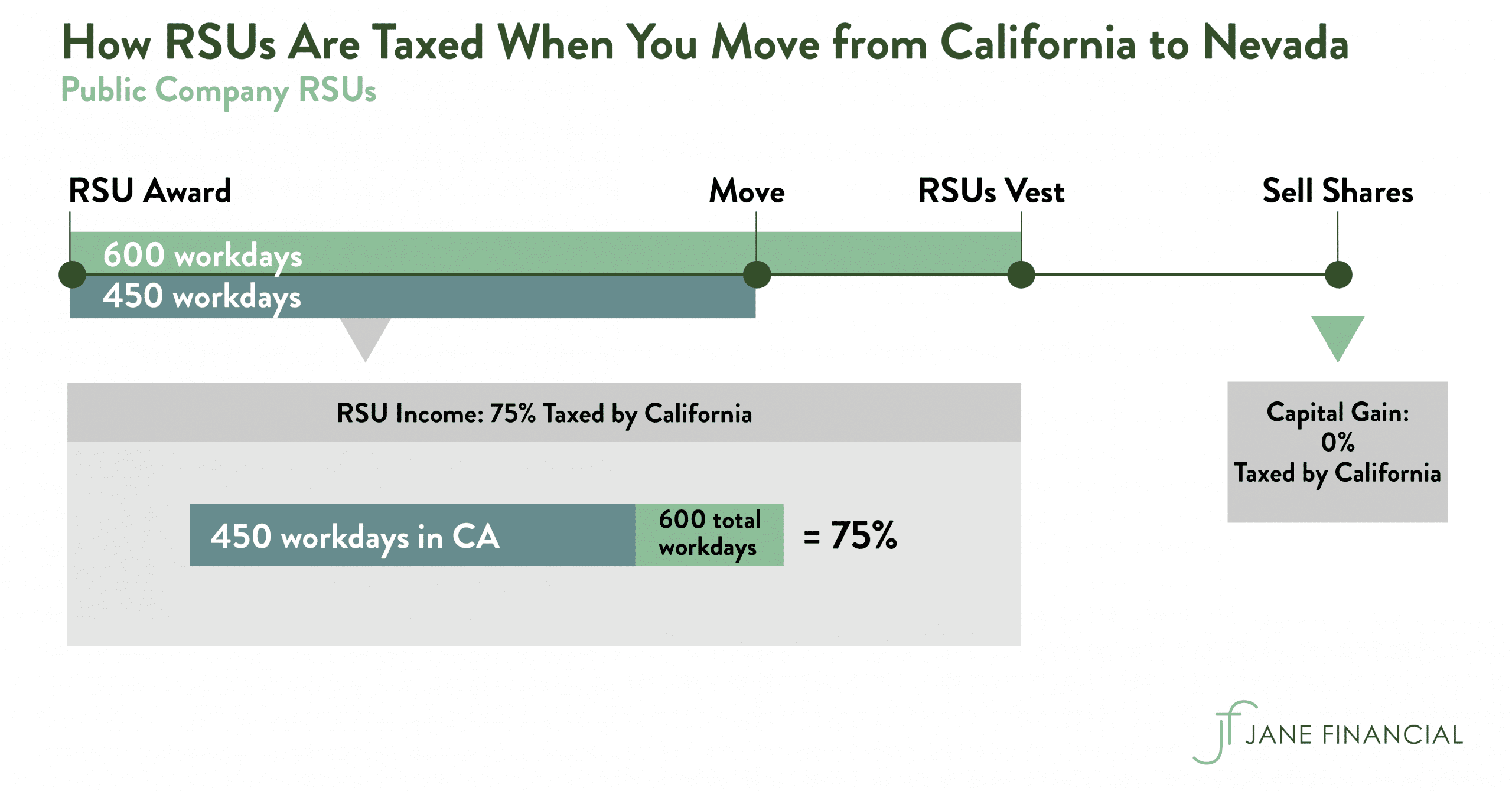

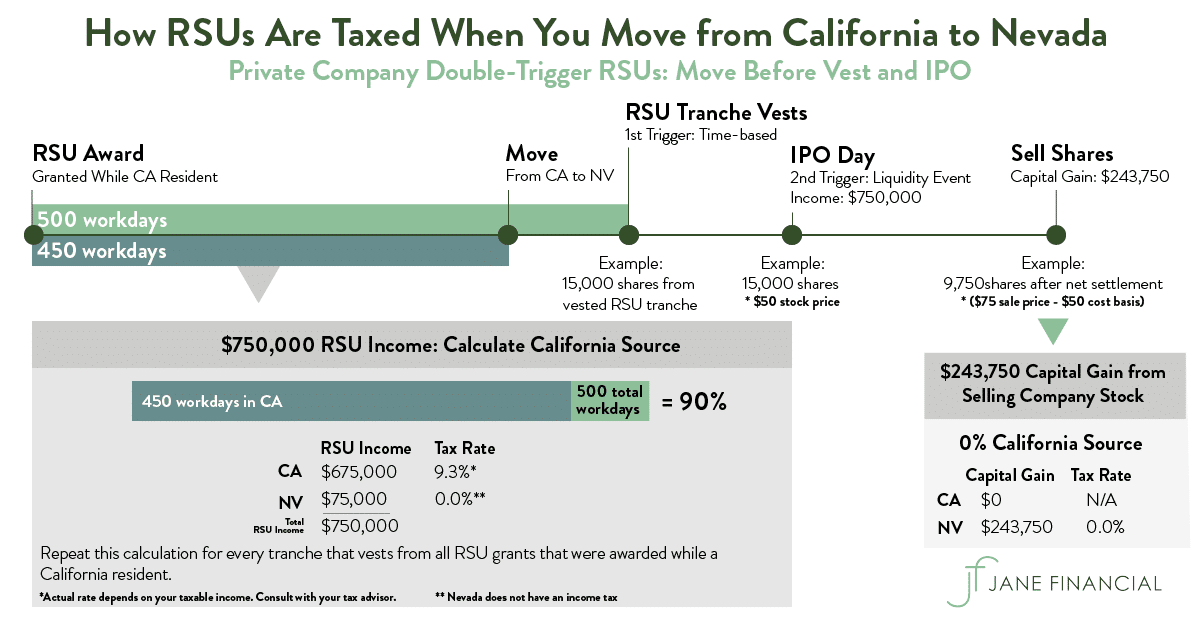

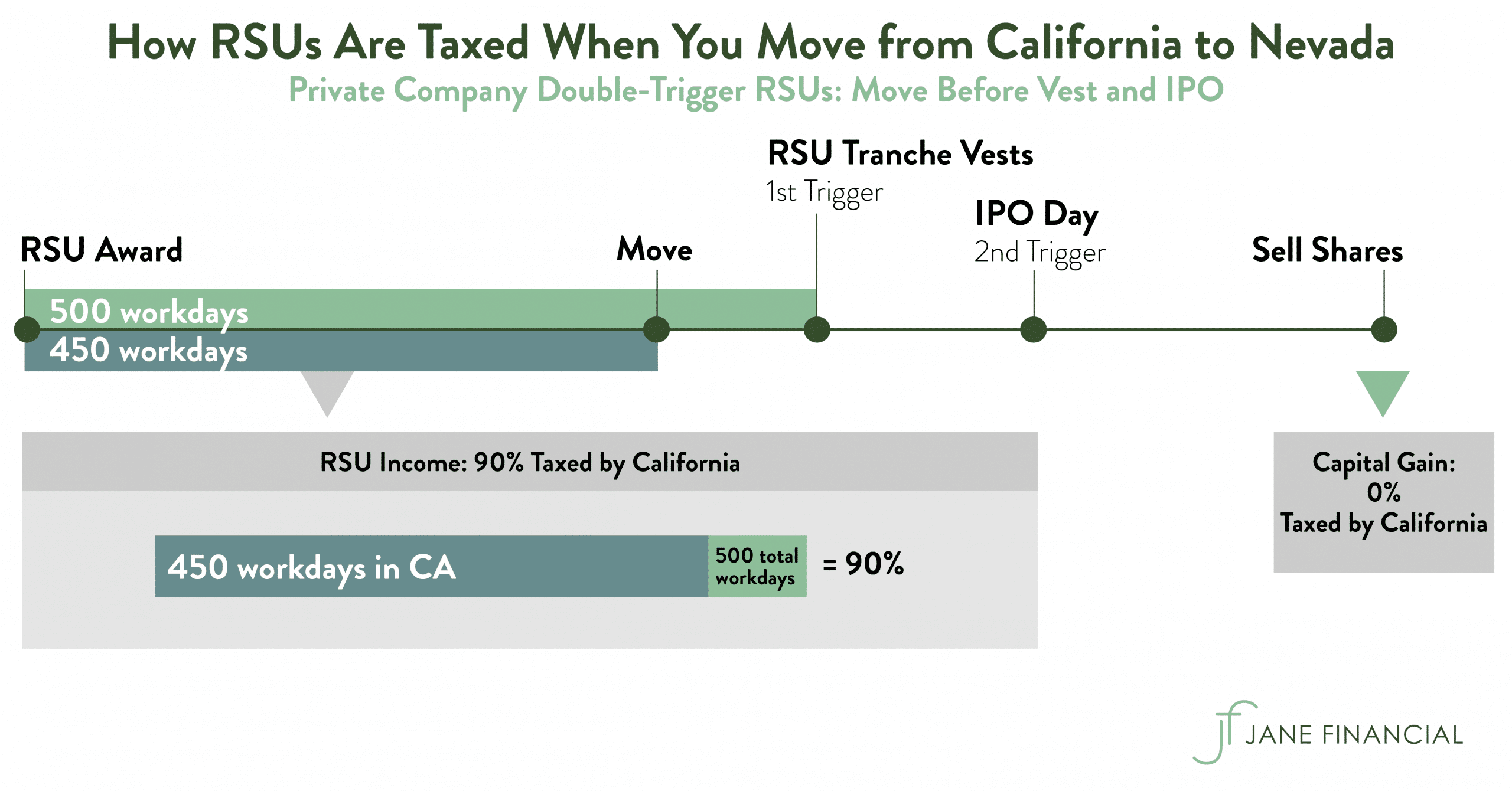

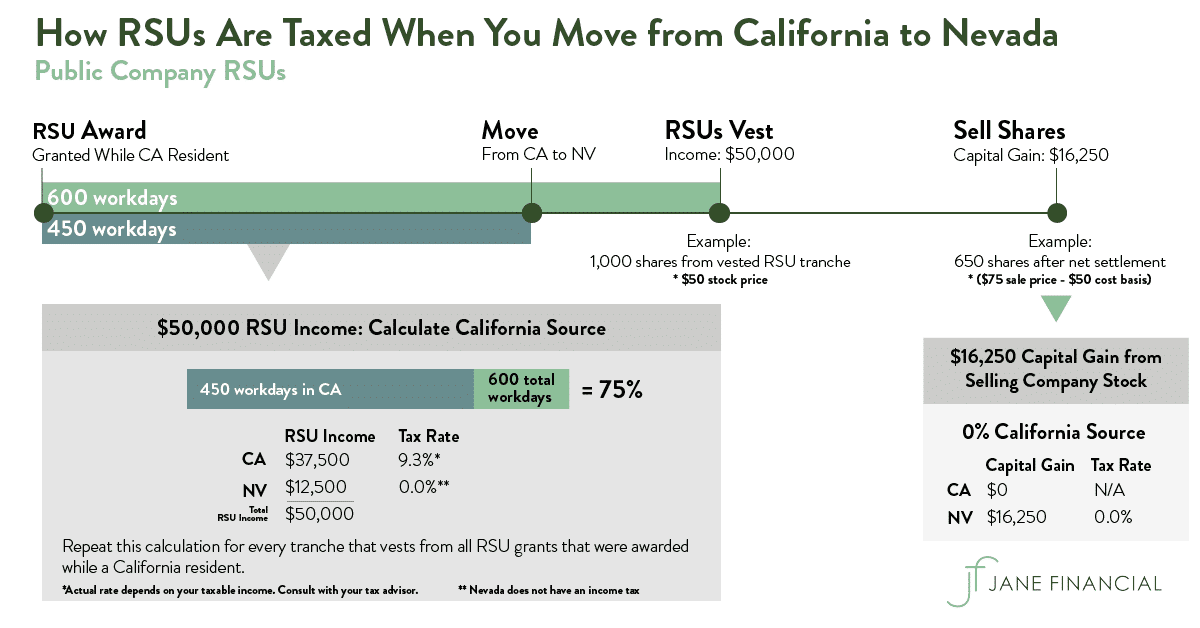

Restricted Stock Units Jane Financial

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Restricted Stock Units How Rsus Affect Your Clients Taxes Tax Pro Center Intuit

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

Rsus Restricted Stock Units Essential Facts Capital Gains Tax Key Dates How To Apply

Why Rsus Can Make Tax Season Painful

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Units Jane Financial

What Are Rsus On Form W 2 Tax Time Tax One Page Resume

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Units Jane Financial